This was a direct reaction to a poor earnings report, a stagnating user. At best the meta verse presents a great scam for early adopters, much like NFTs.

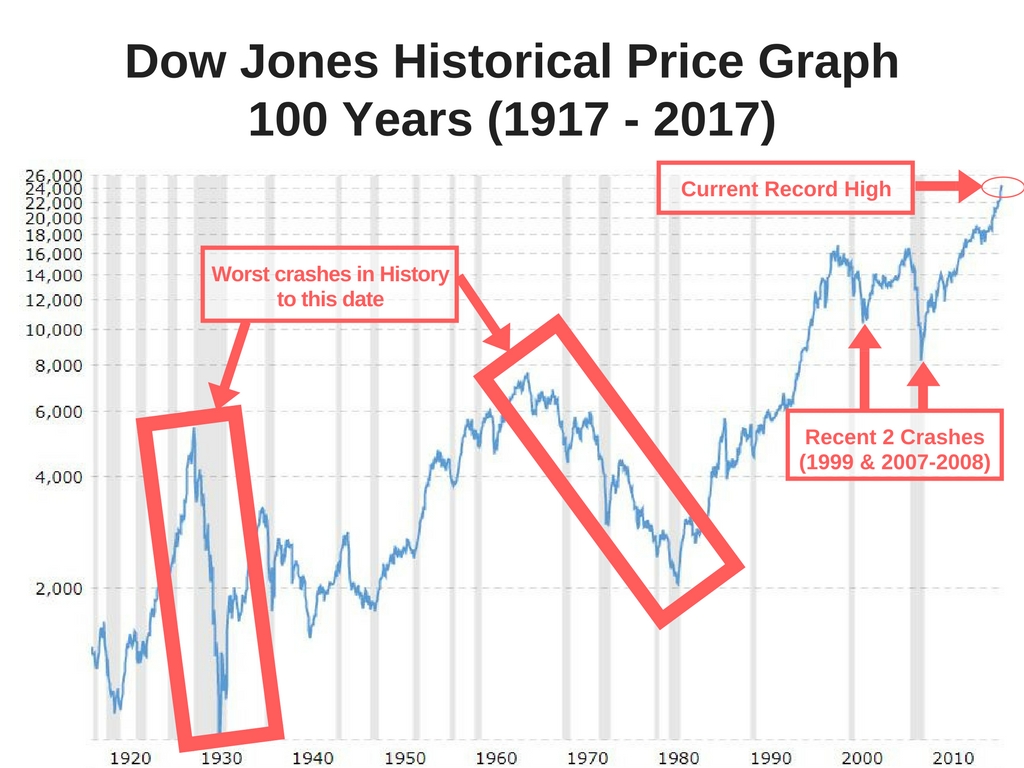

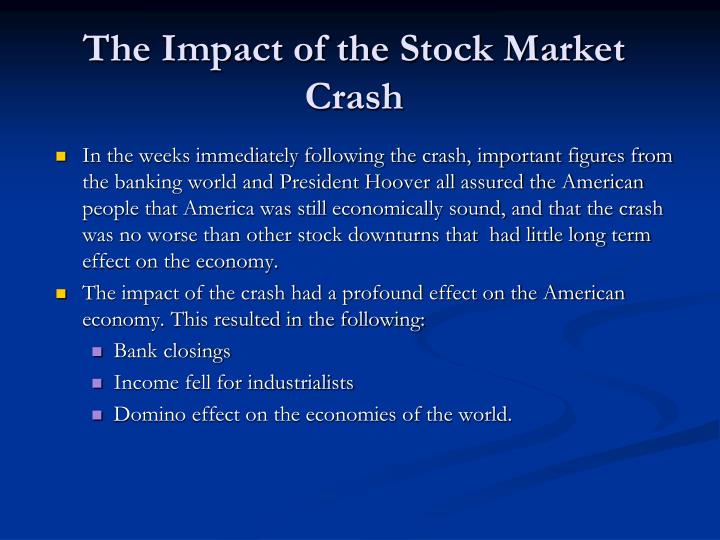

It was the guidance that spooked people," Mr Jeffress said. Meta's shares plunged about 26 percent on Thursday, erasing 250 billion - over a quarter of the company's market value. Anybody who thinks the meta verse is an enduring cultural and economic feat is a blathering idiot. "The results, taken in their entirety, were okay. The company also provided a disappointing sales forecast for the current quarter. Mr Jeffress pointed to strong or increasing numbers Meta reported for user engagement, advertising and revenue per user. Meta Loses 195 Billion In Biggest Ever Crash Mark Zuckerberg’s Net Worth Plunges By 31 Billion. Some portfolio managers also saw a reason to buy.ĭavid Jeffress, portfolio manager at Laffer Tengler Investments, said on Thursday the firm was looking to add to its stake in Meta as the stock declines. PE ratio now is only 14x and it looks exceedingly cheap but why0:00 IntroductionWhat has happened to META stock. It was also a popular stock for retail investors, who appeared to be enthusiastically buying the dip. Facebook stock META dropped 26 on 3feb2022. Other institutional investors were also heavy owners. Meta was a widely held stock by various investor groups, including hedge funds, according to recent data, leaving a number of funds potentially exposed by the wipe-out in its shares. "The tech sell-off spilled over to broader equity markets this morning and, with the Fed preparing to raise interest rates, we could see more volatility going forward." It also reported a rare decline in profit due to a sharp increase in expenses. Meta sank after forecasting revenue that was well below analysts' expectations for the current quarter, a disappointment for a company that investors have become accustomed to delivering spectacular growth. The broader S&P 500 and blue chip Dow Jones Industrial Average had smaller, but still substantial, falls. The tech focused Nasdaq, of which Meta is a major part, plunged 3.7 per cent, to close at 13,879. That means a big swing in either direction for such a company can do much to sink or lift the broader market.

Meta's lofty stock price, as with several other big communications and technology companies, has an outsized influence on markets. Mr Zuckerberg was not the only one losing a lot of money overnight. However, according to the Forbes real time billionaires index, Mr Zuckerberg still has an estimated personal fortune of nearly $US85 billion ($119 billion). Mr Zuckerberg's nearly $US30 billion drop in personal wealth was the second-largest one-day personal loss in history according to US financial news outlet CNBC.Īccording to CNBC, the biggest one-day personal drop in wealth was a $US35 billion loss for Tesla founder Elon Musk in November. The Facebook founder and now Meta CEO spoke in. That’s the big negative, since investors were hoping Meta would aggressively cut costs, said Neil Campling, an analyst at Mirabaud Securities.This decline marked the company's worst one-day loss since its Wall Street debut in 2012, and the biggest single-day loss of dollar value by any listed firm. Meta CEO Mark Zuckerberg gave a public comment on Wednesday following massive criticism over Metas tanking stock price and push into the Metaverse. The company said Wednesday it expects total expenses for this year to be $85 billion to $87 billion.įor 2023, that number will grow to an expected $96 billion to $101 billion. Meta announced its shift to investing in virtual reality a year ago, along with a name change of the company from Facebook Inc. That’s the biggest wipeout in market value for any US company ever.

In February the company value plunged 26 per cent on the back of woeful earnings results, and erased about $251 billion in market value. It has been an annus horribilis for Zuckerburg. Just 10 months later and the stock will be worth about $258 billion, ranking it 26th.īrokers are rumoured to be turning on the company. At least three investment banks - Morgan Stanley, Cowen and KeyBanc Capital Markets - cut their rating on the stock after the company gave a disappointing quarterly revenue outlook. Meta was the sixth biggest US company by market capitalisation at the start of the year, flirting with a $1 trillion market value. Meta's shareholders are paying dearly for its spending on the metaverse: The Facebook parent’s market value has collapsed by a whopping $677 billion this year, forcing it out from the ranks of the world’s 20 largest companies. Meta’s stock is down as much as 25 per cent after it spooked investors with ballooning costs to fund its version of virtual reality and a decline in revenue. Key Facts Meta reported net income of 4.4 billion, or 1.64 per share, cratering 49 year over year and falling short of expectations for 1.89 per share revenue of 27.7 billion fared slightly.

0 kommentar(er)

0 kommentar(er)